Form 8962 Instructions for 2024

As tax season rolls around, understanding the ins and outs of various IRS forms can be the difference between a smooth filing experience and unexpected delays. One of the forms that may appear in your tax paperwork puzzle is IRS Form 8962. In the realm of personal tax, it's a crucial piece that warrants your attention, especially if you've received health insurance through the Health Insurance Marketplace. Our article is a simplified version of the instructions for the 8962 tax form to guide you through the vital moments.

Purpose of the 8962 IRS Tax Form

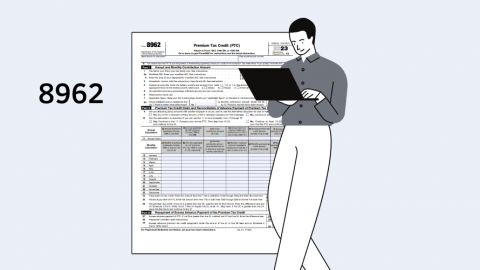

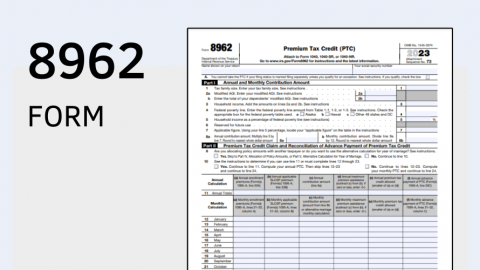

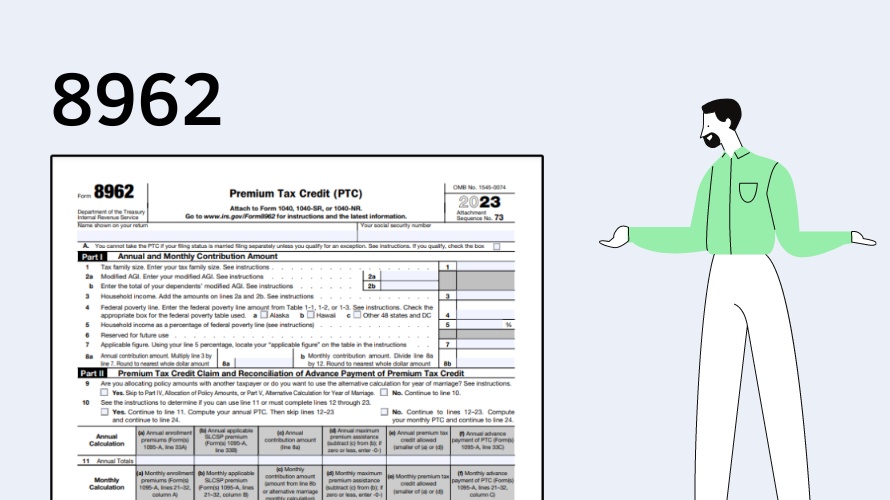

Form 8962 is used to calculate your Premium Tax Credit (PTC) and reconcile it with any advance payments of the credit that the Marketplace might have paid to your health insurance provider on your behalf. If you’ve been on the receiving end of such advance payments, IRS Form 8962 for 2023 with instructions becomes a critical element of your tax filings.

Navigating the intricacies of Form 8962 instructions for 2023 can be a challenge, but fret not. Here's what you need to keep in mind as you strap yourself in for the tax-filing journey:

- Eligibility

You're only required to file Form 8962 if you're eligible for the PTC or if you've received advance payment of the credit in the previous year. - Information Needs

Have your Form 1095-A (Health Insurance Marketplace Statement) at hand. It contains necessary information about your coverage and any advance credit payments received. - Calculations

Accurately calculate the amount of PTC you're eligible for based on your household size and income, then compare it to the advance payments. - Reconciliation

The reason for this whole exercise is to reconcile your actual PTC with advance payments. Depending on the outcome, you may owe additional tax or be due a refund. - Accuracy

Ensure all the data you input matches the necessary tax documents and financial statements to sidestep any discrepancies.

Instructions to Avoid Pitfalls with Form 8962 for 2023

Year after year, taxpayers find themselves entangled in common errors that could easily be avoided. Here's how to steer clear of some of the usual suspects when dealing with 2023 Form 8962:

- Ignoring Form 1095-A

Some filers forget to incorporate information from Form 1095-A into Form 8962, which can lead to delays or an incorrect tax liability. - Inaccurate Income Estimates

Over or underestimating your income can lead to incorrect PTC calculations. Ensure your income is accurately reported. - Misunderstanding Eligibility

Knowing whether you qualify for the PTC is vital. Don't assume eligibility; verify it. - Data Mismatches

Information presented on Form 8962 must jive with what’s on your 1095-A. Double-check for any discrepancies before submitting.

Federal Form 8962: Key Considerations

To keep your tax journey as hiccup-free as possible, treat each line of 2023 Form 8962 following instructions with the utmost importance. Incorrectly filled-out forms or missing information can snowball into bigger issues, such as delays in your refund or a notice from the IRS. If you're uncertain about your eligibility or how to proceed with the form, consider consulting a tax professional or using IRS-approved tax software that can guide you through the process.

Remember that tax laws and guidelines can change, so it’s crucial to be up-to-date with the latest information regarding tax form 8962 instructions for 2023. Our website is a valuable resource, offering comprehensive information and answers to frequently asked questions. By staying informed and meticulous, you'll increase your chances of a trouble-free tax filing experience.

Latest News

-

![Tax Form 8962 in PDF]()

- 19 December, 2023

-

![Printable IRS Form 8962 for 2023]()

- 18 December, 2023