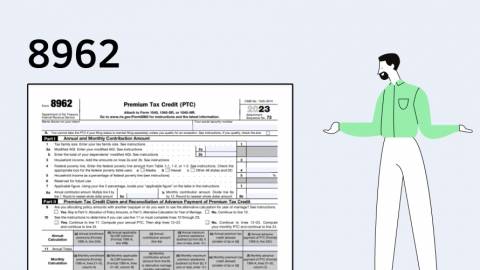

Printable IRS Form 8962 for 2023

Navigating the complex web of the United States tax system can sometimes feel like a skill reserved for the experts. This is especially true when it comes to specific forms like tax form 8962. Whether you are filing taxes for the first time or you have stumbled across this statement unexpectedly, the concept can be daunting. Simply put, the tax form 8962 with instructions for 2023 plays a crucial role in reconciling your premium tax credits associated with health insurance plans purchased through the Marketplace under the Affordable Care Act (ACA).

Unique Scenarios for Filing IRS Form 8962

There are unique instances that might require taxpayers to engage with Form 8962 that aren’t immediately obvious. For example, suppose someone experienced significant life changes such as a marriage or divorce, a job loss or new employment, or even a substantial income fluctuation. In that case, these events may alter their eligibility for premium tax credits, thus necessitating Form 8962 for correct reconciliation.

In another atypical scenario, if taxpayers' income ends up being lower than estimated when they applied for health insurance, they may have received too little in advance premium tax credits. Conversely, if the income is higher than estimated, they might need to pay back some of these credits. In such cases, one should review the instructions for IRS Form 8962 for 2023 meticulously to ensure appropriate adjustments are made.

Correcting Errors on the 8962 Tax Form for 2023

No one is immune to making mistakes, and a slip-up on Form 8962 can be rectified with the right steps. If you discover an error after submission, you'll need to file an amended tax return using Form 1040-X and attach a corrected Form 8962. Make sure you review the entire form for potential errors and inaccurately reported information related to your premium tax credits — do not alter only the sections with mistakes. Accuracy is key to preventing further complications or delays in processing your taxes.

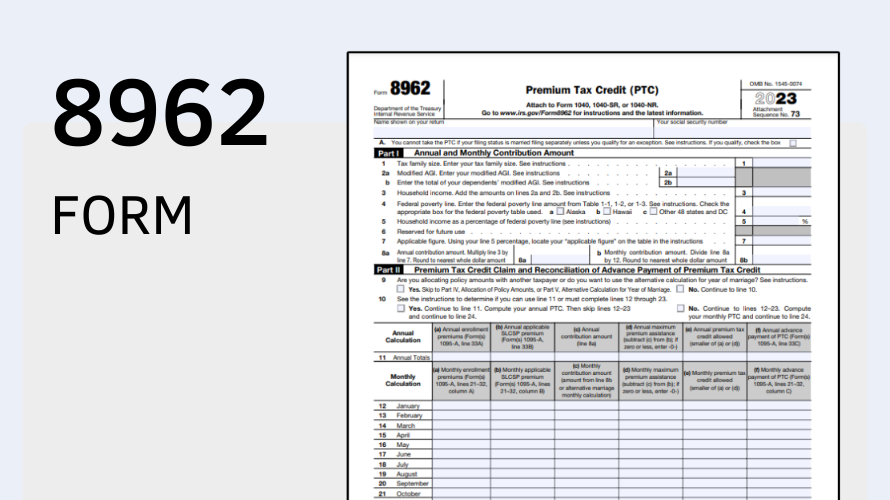

2023 Form 8962: Calculating Premium Tax Credits

Understanding Annual and Monthly Calculations:

| Component | Explanation |

|---|---|

| Annual Totals | All figures used to calculate your annual household income and establish the percentage of the federal poverty line that this income represents. |

| Monthly Premiums | Calculation of your monthly premium amounts for both the plan in which you were enrolled and the second lowest cost silver plan (SLCSP) – used as a benchmark. |

| Advance Payment Amounts | Reconcile the amount provided as advance payment of the premium tax credit with the actual credit you qualify for at year’s end. |

The calculations require meticulous attention to detail, as errors can result in either missing out on credits due to you or owing additional money to the IRS. The printable IRS Form 8962 for 2023 is available on our website for your convenience.

Form 8962 & Frequently Asked Questions

- Can I print and file Form 8962 by hand?

Yes, if you prefer paper filing, you can fill out Form 8962 for 2023 manually. Make sure to write legibly and use black ink to avoid any processing issues. - What should I do if I can't find my Second Lowest Cost Silver Plan (SLCSP) amount?

You can find the SLCSP amount by logging into your Marketplace account or calling the Marketplace if you didn’t receive a Form 1095-A. - Is there a way to fill out Form 8962 online?

Indeed, there is a fillable Form 8962 for 2023 that allows for convenient digital completion. This interactive version of the form can help minimize errors and is accessible on our website.

Latest News

-

![Form 8962 Instructions for 2024]()

- 20 December, 2023

-

![Tax Form 8962 in PDF]()

- 19 December, 2023