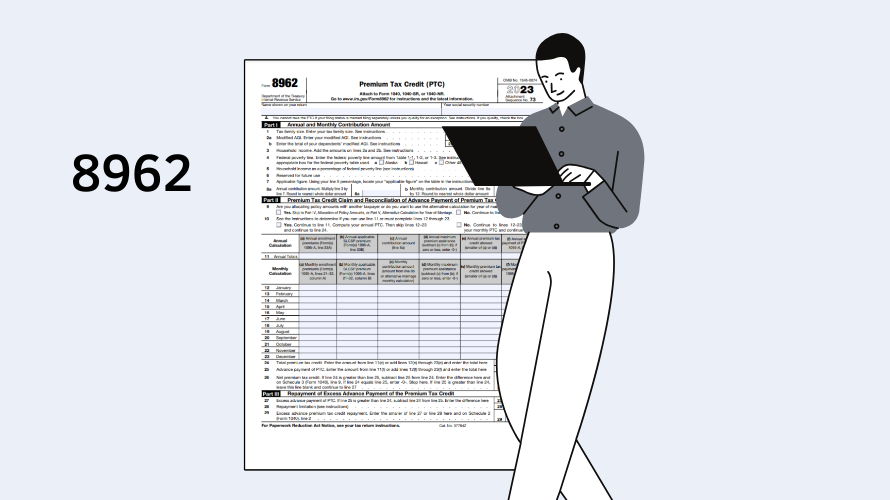

Tax Form 8962 in PDF

The Internal Revenue Service (IRS) Form 8962, the Premium Tax Credit (PTC) form, is an important document for taxpayers who want to calculate and report their premium tax credit on their federal income tax return. This credit assists individuals and families in offsetting the cost of health insurance purchased through the Health Insurance Marketplace. If you have received advanced payment of these credits throughout the year, you should reconcile the amount on your tax return using Form 8962.

Features of the Editable 8962 Form

An editable Form 8962 for 2023 in PDF brings about a world of convenience for taxpayers. This digital format lets individuals interactively fill out their information directly on their computer, negating the need for a printed copy. The form fields are designed to collect the necessary information in a structured manner, which reduces errors that can come from handwriting. Moreover, calculations can be automated, further ensuring accuracy. To benefit from these features, one must have a compatible PDF reader that allows form input and saving.

Form 8962 Online Filing: Navigating Challenges

Filing the tax form 8962 in PDF format online may expose filers to certain complexities. For starters, technological issues such as software compatibility or PDF reader limitations can arise, which may affect the ability to save or print the completed form. Additionally, ensuring the accuracy of the auto-filled data is critical since incorrect information can lead to delays or incorrect calculation of your tax credits. It’s essential to be patient and double-check all entries for accuracy before submission.

Best Practices for Fillable 8962 Form

To guarantee a smooth process when tackling the IRS Form 8962 in PDF, follow these guidelines:

- Gather all necessary documentation, such as Form 1095-A, which details health insurance coverage and any advance payments of the premium tax credit.

- Ensure you're using the latest version of a PDF reader that supports form-filling and saving features.

- Go through each part methodically, filling in all required information accurately.

- Utilize the IRS instructions for Form 8962 in PDF with instructions to clarify any doubts regarding specific lines or calculations.

- Be cautious of deadline dates for filing, as late submission can affect your credit eligibility.

Maintaining Security on the 8962 Online Form

When dealing with sensitive personal data, it is crucial to take protective measures to prevent unauthorized access or identity theft. Here are some tips to secure your personal information:

- Use a secure and private internet connection; avoid public Wi-Fi networks when filling out or submitting your form online.

- Ensure your computer has up-to-date antivirus and anti-malware software.

- After completing the 8962 PDF form, store it securely, and be cautious about where and how you share the file.

- Consider submitting your tax return through the IRS’s authorized e-file providers, offering an additional security layer.

- Never share your Social Security number or other sensitive information via email or over an insecure channel.

Securing your data is as important as accurately completing your tax forms. Being proactive in both aspects will contribute to a trouble-free tax filing experience.

Latest News

-

![Form 8962 Instructions for 2024]()

- 20 December, 2023

-

![Printable IRS Form 8962 for 2023]()

- 18 December, 2023