Printable 8962 Tax Form

All About IRS Form 8962 and Affordable Care Act Credits

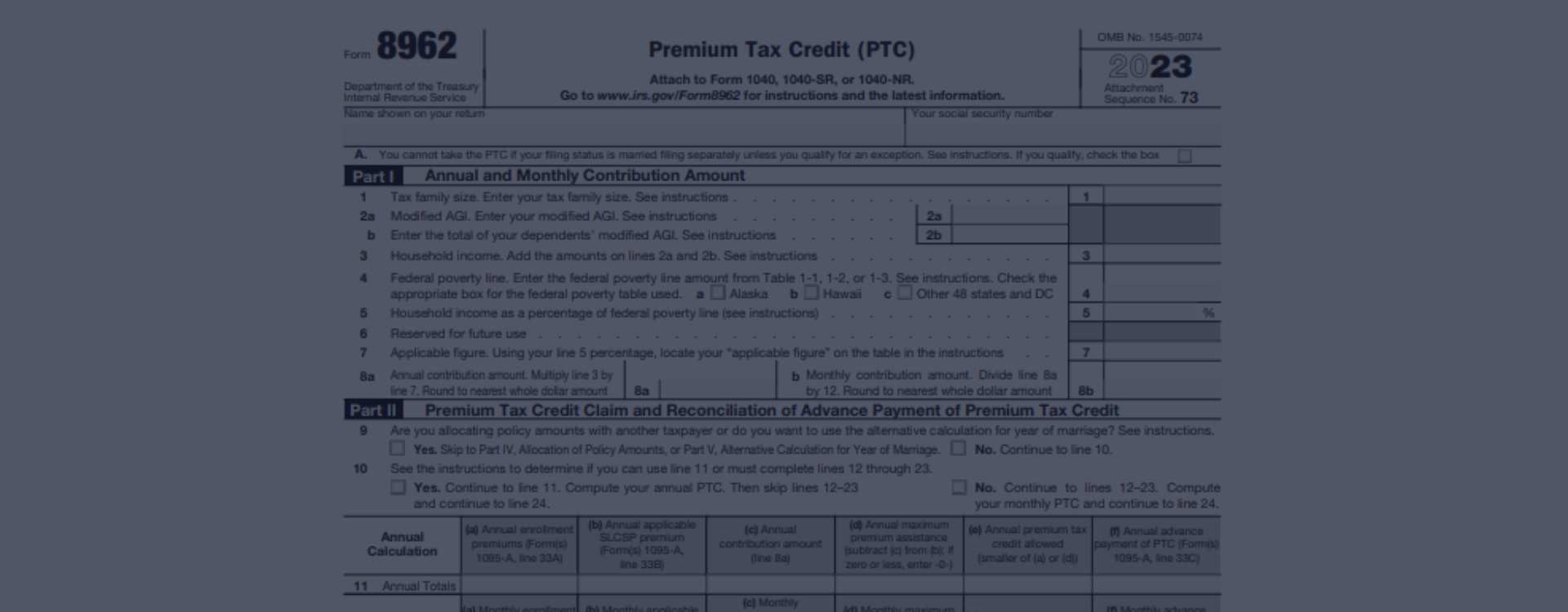

IRS Form 8962 is integral for taxpayers who have received premium tax credits for medical insurance purchased through the Health Insurance Marketplace. It's used to reconcile the amount of credit received throughout the year with the actual premium tax credit eligibility based on final income figures. Accurately completing printable tax form 8962 ensures that individuals maintain eligibility for future credits and avoid potential penalties for misreporting.

Navigating the complexities of this printable tax form can be challenging, but resources such as 8962-form-printable.org significantly streamline the process. Our website provides a wealth of materials, including comprehensive instructions for Form 8962 for 2023, which guide taxpayers step by step through the completion of the document. Additionally, users can benefit from practical examples that clarify how to report their information on the printable IRS tax form 8962 accurately. The site makes managing one's personal tax matters much more straightforward, reducing errors and the time investment required to fulfill this obligation.

Primary IRS 8962 Tax Form Rules

To comply with IRS regulations, individuals who received a premium tax credit (PTC) must file Form 8962 with their federal return. This reconciliation form is pivotal for taxpayers who purchased health insurance through the Marketplace and wish to align their credit with their income level. Insured parties must complete this statement to report the amount of PTC received and determine if they are eligible for additional credit or must repay any excess received based on their annual income. There is a list of people below who usually need to deal with Form 8962.

Cases of Federal Tax Form 8962 Usage

|

|

To maintain compliance with the tax law, both Rachel and Ethan need to file IRS Form 8962 with their annual returns. By doing so, they will reconcile any discrepancies between their estimated income and the advance payment of the premium tax credit, ensuring their fiscal obligations are accurately met.

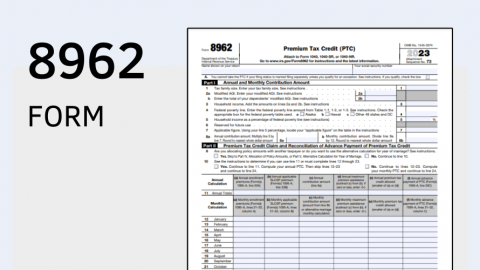

Instructions for the Printable 8962 Tax Form Filling

Filling out the free printable 8962 form for 2023 is a critical process for anyone who has received advance payments of the premium tax credit (APTC) for health insurance. This document reconciles the amount of APTC you received with the premium tax credit you're eligible for. Below is a step-by-step guide to complete the template accurately.

Filing the IRS 8962 Form

When preparing your taxes, completing and submitting the 2023 IRS Form 8962 printable is essential if you received a premium tax credit. The due date for filing typically aligns with the federal tax deadline, which is usually April 15, unless it falls on a weekend or holiday, in which case the deadline is the following business day. It's crucial to ensure accuracy on this form, as penalties for late submission or misrepresentation can be steep.

To assist with proper completion, you can refer to a sample of Form 8962, which can provide guidance on how to report your premium tax credits. Remember, failure to file Form 8962 on time can result in a loss of premium tax credits and could lead to additional fines. Similarly, deliberately providing false information may lead to severe penalties, including fines or criminal prosecution. It is imperative to handle this document with diligence and honesty.

Tips for Correct PTC Calculations on Form 8962

To make calculations on the free printable 8962 tax form accurate and hassle-free, follow these tips:

- Before starting, ensure you have your Form 1095-A, which details your Health Insurance Marketplace coverage and any advance premium tax credit received.

- Familiarize yourself with the IRS instructions for Form 8962 to accurately calculate your premium tax credit and reconcile it with any advance payments.

- For an error-free experience, leverage the IRS’s online tools and calculators. They can help with complex parts, like figuring out your 'household income' and 'family size.'

Free Printable 8962 Form: Questions & Answers

More Instructions on How to Fill Out Form 8962

Please Note

This website (8962-form-printable.org) is an independent platform dedicated to providing information and resources specifically about the 8962 printable form, and it is not associated with the official creators, developers, or representatives of the form or its related services.